In addition to the borrowing proposal, President Tinubu has submitted the Medium-Term Expenditure Framework (MTEF) for 2025-2027 and the National Social Investment Programme Establishment Amendment Bill.

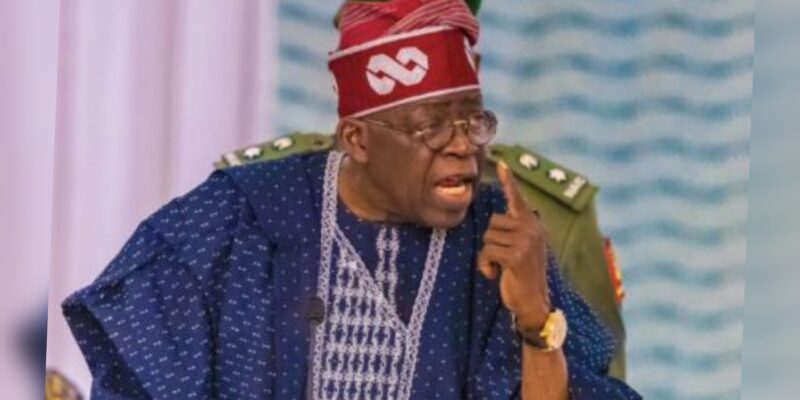

Abuja, Nigeria – President Bola Tinubu has requested the National Assembly’s approval for a new external borrowing of N1.767 trillion as part of the 2024 appropriation act.

The proposed loan is intended to partially cover the N9.7 trillion budget deficit for the year. The request was formally presented to lawmakers by the Speaker during Tuesday’s plenary session.

In addition to the borrowing proposal, President Tinubu has submitted the Medium-Term Expenditure Framework (MTEF) for 2025-2027 and the National Social Investment Programme Establishment Amendment Bill. This bill aims to institutionalize the social register as the primary mechanism for the federal government’s social welfare programs.

Meanwhile, new figures from the Central Bank of Nigeria (CBN) show that the federal government spent $3.58 billion on foreign debt servicing during the first nine months of 2024. This represents a sharp 39.77% increase from the $2.56 billion spent in the same period of 2023. The CBN report highlights significant fluctuations in debt servicing costs, with the highest payment recorded in May 2024 at $854.37 million, a 286.52% surge compared to May 2023.

Debt servicing costs also spiked dramatically at the start of the year. January saw a 398.89% increase in payments, though February experienced a slight dip. These rising costs illustrate Nigeria’s escalating financial strain amid growing debt obligations.

The country’s mounting debt is further reflected in a recent report from Channels Television, which revealed an increase in the combined debts of Nigeria’s 36 states. By June 2024, state debt had grown to N11.47 trillion, up 14.57% from December 2023. External debt also rose from $4.61 billion to $4.89 billion over the same period, largely due to the devaluation of the naira, which has intensified the debt burden in local currency terms.

Despite the rising external debt, domestic debt levels for the states and the Federal Capital Territory (FCT) have shown a decline. Overall public debt, including that of the states, was recorded at N134.3 trillion by June 2024, a reduction from the previous figures in December 2023. Nevertheless, the ongoing trend of increased foreign borrowing against domestic fiscal challenges continues to add pressure on Nigeria’s debt servicing capacity.

Additionally, a report from BudgIT highlights the fiscal vulnerability of many states, noting that 32 states depend on federal allocations for at least 55% of their revenue. This heavy reliance on the Federation Account Allocation Committee (FAAC) raises concerns over fiscal sustainability, as any fluctuations in oil revenue or external economic shocks could severely impact state finances.

Join our Channel...