CBN Pushes for Financial Inclusion to Drive Economic Growth

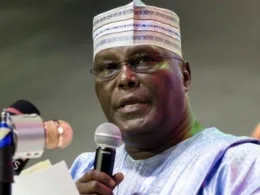

At the recent 2024 International Financial Inclusion Conference in Lagos, the Central Bank of Nigeria (CBN) revealed a concerning statistic: 28 million Nigerians remain without access to formal banking services. CBN Governor Olayemi Cardoso emphasized that advancing financial inclusion is essential not only to uplift these individuals but to secure broader economic stability and growth.

Data from the Access to Finance (A2F) survey by Enhancing Financial Innovation and Access (EFInA) illustrates a clear gap, with 26% of Nigeria’s adult population excluded from essential financial services like savings, loans, and insurance. This exclusion affects the economy, particularly by limiting the financial independence and growth opportunities for millions.

Cardoso highlighted that financial inclusion directly impacts poverty reduction, income equality, job creation, and economic productivity. “Financial inclusion is critical for poverty reduction, income equality, employment generation, and overall productivity,” Cardoso noted.

While the importance is clear, challenges persist. Many Nigerians in underserved regions face barriers such as limited awareness of financial products, insufficient infrastructure, and gaps in digital literacy.

The CBN’s National Financial Inclusion Strategy (NFIS), launched in 2012, has made strides by reducing exclusion rates from 46.3% in 2010 to 26% in 2023. Recently, the CBN has also revised capital requirements for Nigerian banks, aiming to ensure that these institutions can extend more support to underserved communities. Cardoso remarked, “This policy not only strengthens financial stability but also serves as a catalyst for inclusive growth.”

Embracing technology has been pivotal in this drive toward inclusion, with digital payment systems and mobile banking channels proving effective in reaching Nigeria’s unbanked population.

The CBN is also calling for cooperative efforts among stakeholders from government agencies and banks to NGOs, to achieve an ambitious 95% financial inclusion target by 2030.

Join our Channel...