CBEX Reopens Operations Amid Controversy and Ongoing Investigations into Nigerian Crypto Scam

The Crypto Bridge Exchange (CBEX), a digital trading platform embroiled in allegations of scamming over 600,000 Nigerians of approximately N1.3 trillion, has resumed activities and introduced new withdrawal options aimed at restoring investor confidence. Despite the ongoing investigations into the alleged financial misconduct, the platform is allowing new user registrations, trading, and profit withdrawals.

Sources close to CBEX reveal that an external audit of the company’s financial records, alongside an insurance verification process, is currently underway to establish the true extent of the losses. They also indicated that old investors will be able to withdraw funds starting June 25, 2025, once the audit is completed.

Meanwhile, new users are permitted to register, fund their accounts, and withdraw profits without restrictions, as these accounts are not part of the ongoing audit. CBEX’s promoters deny claims of fraudulent activity, asserting that investor funds remain secure. They attribute the reported losses to a malfunction involving an AI trading incident and emphasize that the platform has insurance coverage. The platform is also reportedly insured, with verification of funds ongoing by an insurance provider.

The platform has launched a referral program for new investors, offering bonuses that can be withdrawn immediately. According to one source, withdrawals from old accounts are temporarily restricted because the UK government is conducting an audit of CBEX’s financial accounts, expected to last between 30 to 60 days. During this period, investors with old accounts can only withdraw up to 50% of their capital starting June 25, with the remaining funds accessible after August 25, provided verification requirements are met. For example, an investor with a $1,000 stake can initially withdraw $200, then $400, and eventually access the full amount after completing the necessary verification steps.

Sources also clarified that while new investors can register and trade freely, the old accounts are under review due to the alleged N1.2 trillion scam, which the Nigerian government claims was significantly overstated. CBEX’s promoters assert that only N126 billion was lost and that the discrepancy is being addressed through the audit process. They further explained that the AI trading system, which operated automatically before an incident on April 14, was responsible for the loss, but recent changes now require traders to manually input signals, with the platform providing codes for trading decisions.

Regarding the absence of Nigerian government involvement in the audit, sources stated that CBEX is registered in the United Kingdom, with operations extending to Kenya, South Africa, and Egypt, and that the UK authorities are overseeing the investigation.

Communication within a newly established Telegram group underscores ongoing efforts to clarify the situation. An admin named Laura explained that the platform’s issues stem from an organized and premeditated attack on its AI system, which compromised trading strategies. She indicated that the attack was not the work of individuals but an orchestrated cyber assault, referencing a recent hacker incident involving Bybit as evidence of the sophistication involved. Laura emphasized that the investigation is ongoing and that the UK government’s findings will determine what information will be publicly released.

She also urged users to accept the claims process initiated by the insurance company linked to the ST Fund firm, which is responsible for verifying account authenticity and issuing compensation for losses allegedly caused by the April 14 AI incident. She claimed that many users have already begun receiving payouts and dismissed rumors suggesting CBEX administrators transferred over $800 million in assets, describing such reports as slanderous and false. She explained that the exchange uses multiple deposit addresses and regularly updates wallet information to prevent such misconceptions.

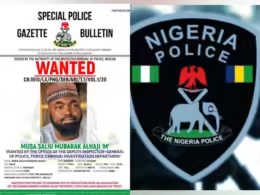

Despite CBEX’s efforts to reassure users, regulatory agencies in Nigeria remain cautious. The Securities and Exchange Commission (SEC) and the Economic and Financial Crimes Commission (EFCC) have issued warnings to the public about the platform’s promises of unusually high returns. The EFCC has also declared eight individuals wanted for promoting the scheme, with investigations ongoing.

As the saga unfolds, the international community continues to monitor the case, with negotiations reportedly ongoing between UK and Nigerian authorities concerning the incident’s broader implications. The outcome of the UK government’s investigation will likely shape the future of CBEX and its ability to operate within the region.

![Netherlands To Return 119 Benin Bronzes To Nigeria In Landmark Move [PHOTO] Netherlands To Return 119 Benin Bronzes To Nigeria In Landmark Move](https://reportafrique.com/wp-content/uploads/2025/02/images-49-2-260x195.jpeg)

Join our Channel...