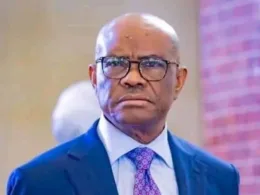

In a landmark case that sent shockwaves through the cryptocurrency world, Changpeng Zhao, Binance founder was sentenced to four months in a US prison after pleading guilty to money laundering charges. This development marks one of the most high-profile cases in the crypto sphere since the incarceration of Sam Bankman-Fried.

Zhao, the Binance founder, tendered his resignation from his position as the head of the world’s largest cryptocurrency exchange platform late last year as part of a plea deal with US authorities. The charges stemmed from investigations by two Treasury agencies, which revealed that Binance had failed to prevent illicit transactions associated with groups such as the Islamic State, al-Qaeda, and the armed wing of Hamas.

In February, Binance agreed to a hefty settlement of $4.3 billion to resolve the charges, underscoring the gravity of the violations. Prosecutors, however, sought a more severe punishment, requesting a three-year prison term, despite such crimes typically resulting in probation.

The Justice Department lambasted Zhao’s actions, accusing him of knowingly flouting US laws to expand his company and enrich himself. They emphasized the broader implications of the case, stating that the sentence would serve as a deterrent not only to Zhao but also to the global cryptocurrency community.

In response, Zhao’s legal team argued for leniency, citing his acceptance of responsibility and philanthropic endeavors. Zhao himself acknowledged his mistakes, expressing remorse in a statement posted on social media. Despite residing in the United Arab Emirates, Zhao has been in the United States since November, cooperating with authorities.

Binance, established in 2017 and once dominant in the crypto-trading market, saw its fortunes dwindle following regulatory scrutiny and market downturns. Zhao relocated its operations internationally after facing pressure from Chinese authorities, ultimately transitioning away from its Chinese roots.

The crypto industry experienced a rollercoaster ride in recent years, with rapid growth fueled by celebrity endorsements and complex financial products. However, a series of scandals, including the collapse of Binance’s main rival, FTX, and criminal charges against industry figures, eroded public trust and triggered investor withdrawals.

FTX founder Bankman-Fried received a hefty 25-year prison sentence earlier this year, further highlighting the regulatory crackdown on the crypto sector. Despite these setbacks, the industry saw a resurgence, buoyed by regulatory approvals for exchange-traded funds (ETFs) in bitcoin, which offered investors alternative avenues for trading.

Binance’s newly appointed CEO, Richard Teng, affirmed the company’s commitment to compliance, noting significant investments in regulatory adherence. Teng emphasized Binance’s ongoing collaboration with regulators, signaling a shift towards greater transparency and accountability within the crypto industry.

In summary, Changpeng Zhao’s sentencing underscores the increasing regulatory scrutiny facing cryptocurrency firms and the repercussions of non-compliance. As the industry navigates these challenges, stakeholders are compelled to prioritize regulatory compliance and restore investor confidence to ensure long-term sustainability and growth.

Join our Channel...