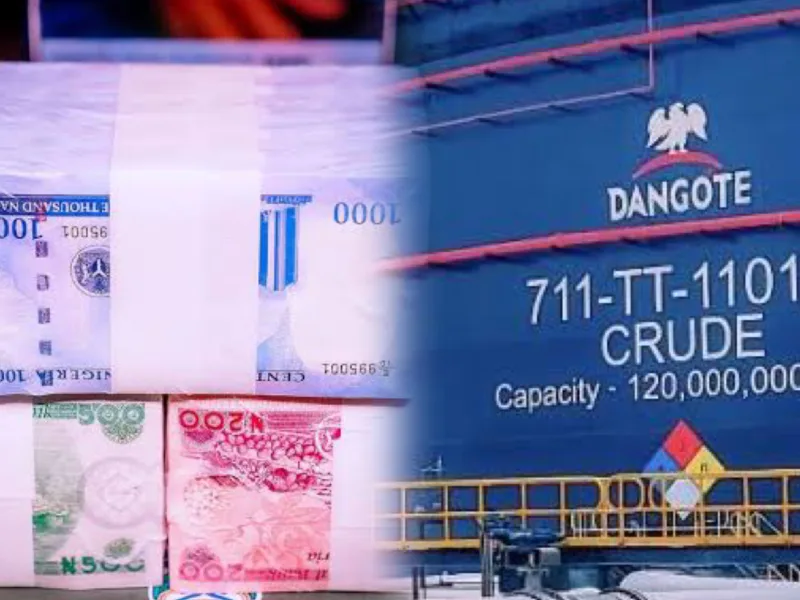

The Federal Government has responded to the demands of domestic crude oil refiners and operators in the sector by allowing indigenous refineries to purchase crude oil in either naira or dollars.

This announcement was made by the Nigerian Upstream Petroleum Regulatory Commission during a briefing in Abuja, where they introduced a new template for domestic crude oil supply obligations.

According to the Permanent Secretary of the Ministry of Housing and Urban Development, Dr. Marcus Ogunbiyi, the decision to offer this flexibility in currency options for purchasing crude oil signifies a significant step towards meeting the needs of stakeholders in the oil and gas industry. This move comes as the government aims to streamline processes and ensure consistent crude oil supply to domestic refineries.

The new template, developed in compliance with the provisions of Section 109(2) of the Petroleum Industry Act 2021, was created in collaboration with key stakeholders, including representatives from NNPC Upstream Investment Management Services, Crude Oil/Condensate Producers, Crude Oil Refinery-Owners Association of Nigeria, and Dangote Petroleum Refinery. The aim is to facilitate a smooth implementation of the Domestic Crude Oil Supply Obligation (DCSO) and support the growth of the midstream sector as outlined in the PIA.

Gbenga Komolafe, the Chief Executive of NUPRC, highlighted the significance of the new template in providing clarity and flexibility in transactional processes. He emphasized that the option to transact in either naira or dollars would alleviate pressure on the country’s foreign exchange rate, particularly in light of the ongoing forex challenges.

In response to inquiries regarding the currency of transaction, Komolafe clarified that payments could be made in either United States dollar or naira, or both, as agreed upon in the Sales and Purchase Agreement (SPA) between the producer and the refiner. This flexibility aims to address the concerns raised by modular refinery operators who have been struggling to access foreign exchange for the purchase of crude oil.

The decision to allow the purchase of crude oil in naira is expected to ease the financial burden on local refineries and oil marketers, who have been grappling with the foreign exchange crisis in the country. Eche Idoko, the Publicity Secretary of the Crude Oil Refinery Owners Association of Nigeria, previously highlighted the challenges faced by modular refineries in accessing dollars for crude oil purchases. He emphasized that selling crude oil in naira would not only ease pressure on the local currency but also make refined products more affordable and accessible to consumers.

In addition to addressing currency concerns, the government also provided updates on the country’s oil and gas reserves. According to Komolafe, Nigeria’s total crude oil and condensate reserves increased to 37.5 billion barrels as of January 1, 2024, with a life index of 68.01 years. Gas reserves also saw a significant increase, reaching 209.26 trillion cubic feet, with a reserves life index of 97.99 years.

These figures underscore Nigeria’s potential to sustain oil and gas production for the foreseeable future and position the country as a key player in the global energy market. As the government continues to explore new frontiers and invest in the development of the oil and gas sector, there are hopes for increased production and economic growth. However, challenges such as funding and resource allocation remain areas of concern, requiring careful planning and collaboration between government and industry stakeholders.

Join our Channel...