Soaring Interest Costs, Growing Deficits, and Aging Population Drive U.S. Debt to Unprecedented $36 Trillion Mark, Sparking Urgent Calls for Fiscal Reform

The United States has reached a sobering financial milestone as the U.S debt surpasses $36 trillion for the first time, according to new data released Friday by the Treasury Department. The debt now stands at $36.03 trillion, marking a record-breaking pace of accumulation.

A Rapid Climb in Debt

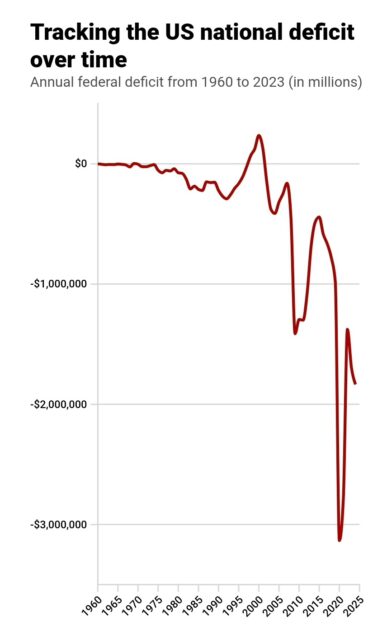

The $36 trillion mark comes just months after the debt crossed $35 trillion in July 2024. Earlier this year, it surpassed $34 trillion in January, following $33 trillion in September 2023. To put this into perspective, the national debt hovered around $907 billion four decades ago.

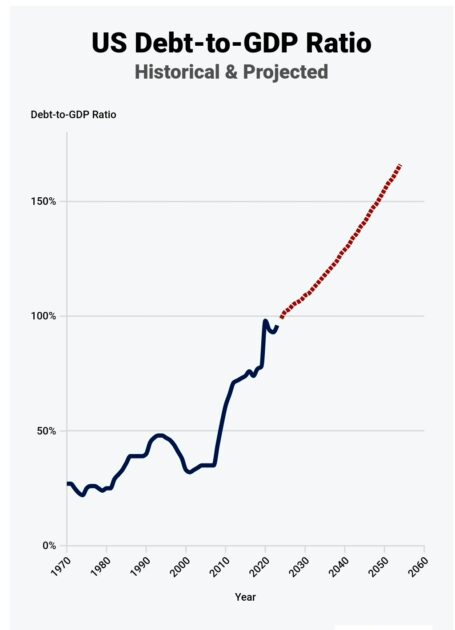

Economists are growing increasingly concerned as debt held by the public—excluding intragovernmental accounts like Social Security trust funds—is expected to equal 99% of the U.S. GDP this year. This figure is projected to break the post-World War II record of 106% by 2027, according to the Congressional Budget Office (CBO).

Expert Warnings: “Sobering and Unsustainable”

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, called the milestone “sobering” and warned of even graver challenges ahead.

“Interest costs are now exceeding spending on nearly every budget item, and trust funds are nearing insolvency,” she said. “Lawmakers must act to put the nation on a sustainable fiscal path.”

Michael Peterson, CEO of the Peter G. Peterson Foundation, echoed the concern.

“This debt spiral needs to stop,”

he said, adding that 2025 will be a critical year for addressing expiring tax cuts, budget caps, and the debt ceiling.

Rising Costs: Interest Payments Outpace Defense and Medicare

The federal budget deficit reached $1.83 trillion in fiscal year 2024, the third-largest in U.S. history. Rising interest rates are compounding the issue, driving net interest payments up by $240 billion last year alone—exceeding spending on defense and Medicare.

Social Security and Medicare also contributed to the ballooning deficit, with expenditures rising by $107 billion and $25 billion, respectively, compared to the previous year.

A Looming Fiscal Crisis

With the 2025 fiscal deadlines approaching, policymakers face mounting pressure to curb the rising debt. While the U.S. economy shows signs of resilience, including low unemployment and improving inflation, experts argue that now is the time to implement sustainable fiscal policies.

“The election may be over, but the debt crisis continues,” Peterson stressed. “America cannot afford to delay action any longer.”

As the debt-to-GDP ratio climbs, the long-term economic implications loom large, underscoring the urgent need for bipartisan solutions to America’s growing fiscal challenges.

Join our Channel...