In its latest staff report released on Thursday, the International Monetary Fund (IMF) has advised Nigeria to implement regulations requiring global cryptocurrency trading platforms to register or obtain licenses to operate within the country. This recommendation comes after the conclusion of the IMF’s 2024 Article IV consultation with Nigeria.

The IMF stressed the importance of establishing a robust regulatory framework to oversee the burgeoning cryptocurrency market in Nigeria. Such regulations would aim to ensure financial stability and protect investors, aligning with global efforts to standardize cryptocurrency regulations and combat illicit activities.

According to the report, global crypto trading platforms operating in Nigeria should be subject to the same regulatory requirements as financial intermediaries, following the principle of “same activity, same risk, and same regulation.”

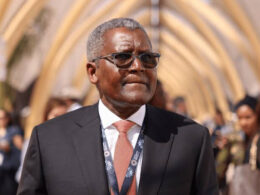

Recent scrutiny of cryptocurrency trading platforms in Nigeria has centered on suspicions of manipulation of the local currency’s value in the foreign exchange market. Emomotimi Agama, the Director General of the Securities and Exchange Commission, emphasized the necessity of delisting the naira from peer-to-peer platforms to prevent such manipulation.

The Central Bank of Nigeria previously directed fintech companies to block accounts engaged in cryptocurrency transactions and report such activities to law enforcement agencies. Additionally, the IMF warned of the challenges posed by the rapid growth of foreign exchange trading platforms in Nigeria to the country’s financial stability.

Acknowledging Nigerian authorities’ efforts to address cryptocurrency-related issues earlier in the year, the IMF emphasized the importance of maintaining external stability. The report highlighted measures taken by Nigerian authorities to curb illicit flows, including through crypto-asset platforms.

In response to concerns about the large volume of transactions passing through crypto exchange platforms from unidentified sources, the Central Bank of Nigeria has been collaborating with other government agencies to address illicit financial activities. The bank revealed that $26 billion passed through Binance Nigeria from unidentified sources within the last year.

In regulatory developments, the Securities and Exchange Commission released new regulations in May 2022 for issuing, offering platforms, and custody of digital assets, signaling a shift towards regulating rather than banning cryptocurrency.

These regulations include a high capital requirement of N500 million for crypto exchanges seeking a Virtual Asset Service Provider lic

Join our Channel...