GtBank’s 40% Salary Boost Aims to Combat Inflation and Retain Talent While Maintaining Market-Leading Cost Efficiency

Guaranty Trust Bank (GTBank), Nigeria’s most cost-efficient commercial bank, quietly boosts its staff salaries by 40% as of September 2024, multiple employees have confirmed. The pay hike comes amid the ongoing cost-of-living crisis in Nigeria, driven by rising inflation and the naira’s significant depreciation.

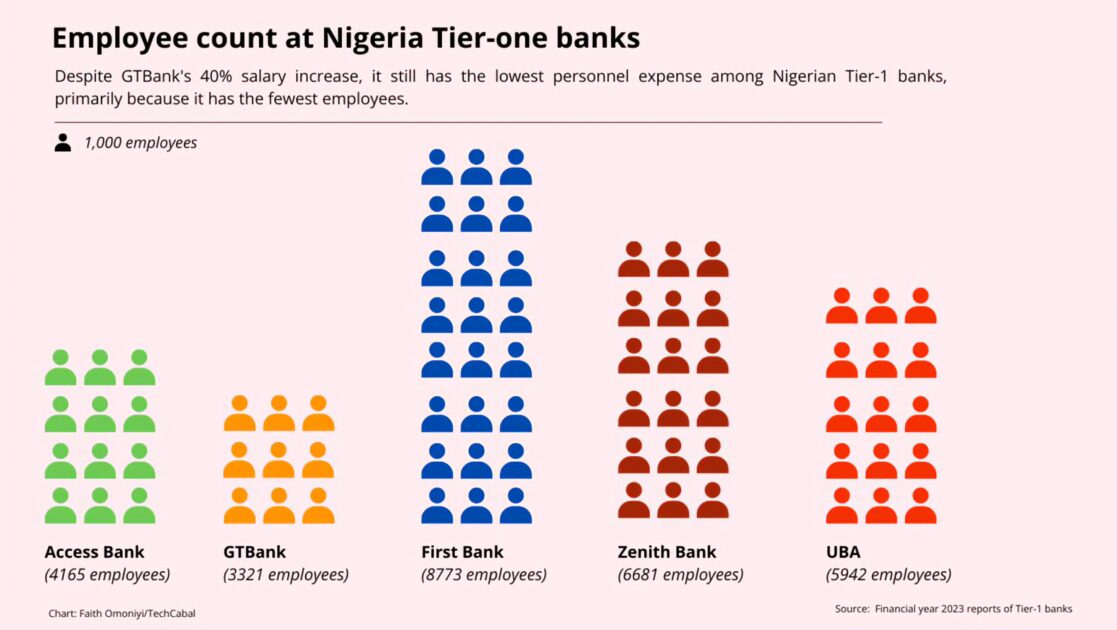

The salary raise, implemented without prior communication, affected all 3,300 employees of the bank.

“Even though there were speculations, I was surprised by the increase,”

said an assistant banking officer (ABO) who now earns ₦720,000 ($442) monthly. GTBank’s employee structure is lean, with fewer levels than other Tier-1 banks, and an ABO is just one level above entry-level staff.

Impact on Cost Efficiency and Tier-1 Status

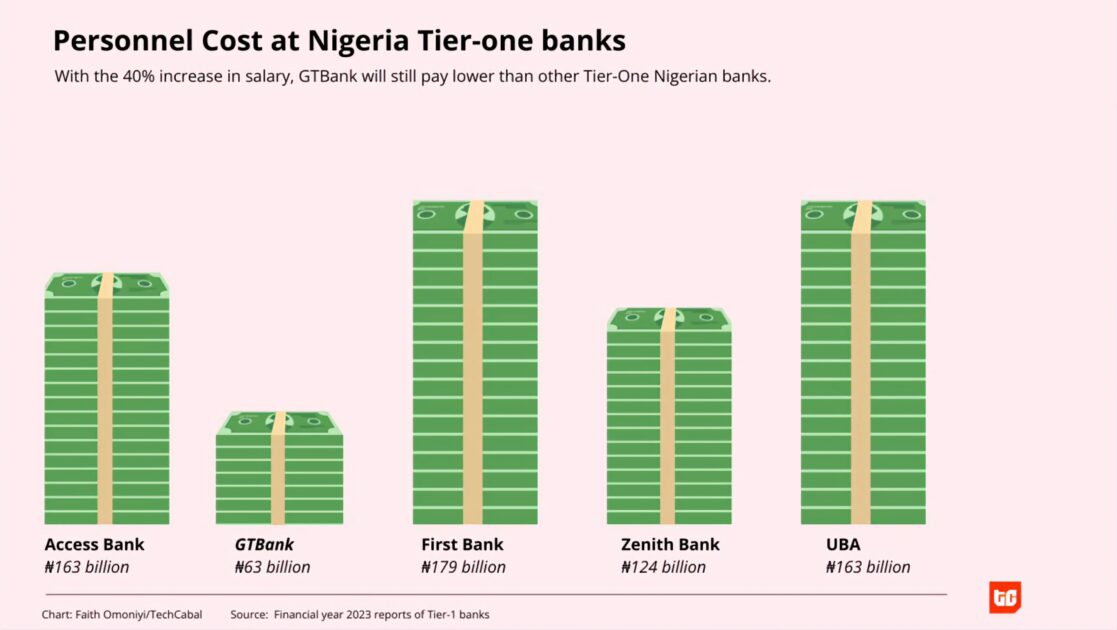

GTBank, which spent ₦45.1 billion ($27.7 million) on salaries in 2023, is known for its industry-leading cost-efficiency. Despite the 40% salary increase, which brings its personnel costs to ₦63.1 billion ($38.7 million), GTBank continues to have the lowest salary bill among Nigeria’s Tier-1 banks. Even with the higher wages, the bank will now spend just ₦0.30 to make ₦1, a slight change from the ₦0.29 cost-to-income ratio it reported in 2023.

Retaining Talent Amid Economic Pressure

The move comes as President Bola Tinubu’s economic reforms, including the removal of fuel subsidies and multiple naira devaluations, have driven inflation up to 30%. With the naira losing nearly 70% of its value against the dollar, Nigerian businesses and households are grappling with soaring costs.

While GTBank’s salary increase may ease employee concerns about inflation, industry insiders suggest the raise could also be aimed at retaining talent in a competitive job market. In 2022, the bank doubled salaries for its technology team after facing significant employee turnover to other banks and overseas opportunities. Tech employees at GTBank still out-earn other divisions, with an ABO-level staff in tech earning around ₦1 million ($613) monthly.

This latest salary raise marks the second increase for GTBank staff in two years and breaks from the typical industry pattern where only head office employees benefit from such adjustments. GTBank did not immediately respond to requests for comment on the matter.

Cost-Efficiency Maintained Despite Higher Wages

Despite the substantial raise, GTBank’s personnel costs remain far below those of its Tier-1 peers, with some spending at least three times more on salaries. This aligns with the bank’s long-standing reputation for cost-efficiency and profitability, ensuring that the latest salary adjustment does little to shake its industry-leading status.

The bank’s strategic move reflects the delicate balance Nigerian companies must strike between controlling costs and retaining critical talent in a rapidly changing economic landscape.

Join our Channel...