Trump’s Executive Order Boosts Crypto Market, Proposes National Crypto Reserve

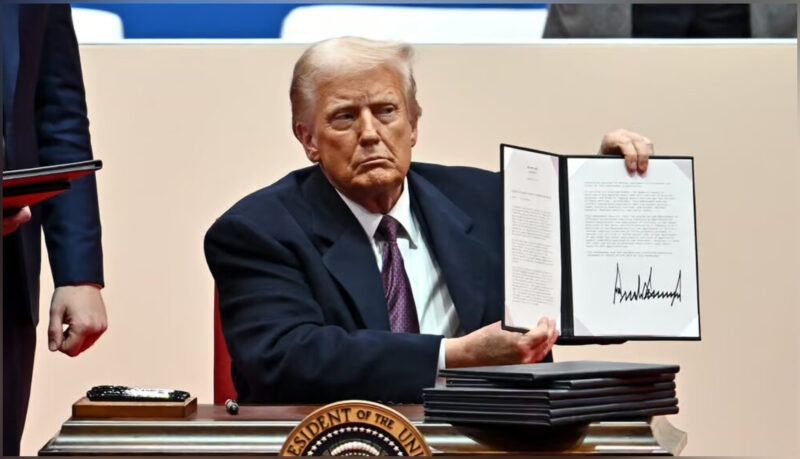

In a significant move aimed at reinforcing the United States’ leadership in the realms of cryptocurrency and artificial intelligence (AI), President Donald Trump has enacted an executive order that bans central bank digital currencies (CBDCs) and sets up a working group to establish clear regulations for the crypto sector. This sweeping directive is meant to support innovation, reduce regulatory ambiguity, and protect individual financial freedom.

Following this announcement, Bitcoin (BTC), the leading cryptocurrency, experienced a notable 3% increase, reaching $105,000 during Friday’s trading session. One key element of the executive order is the introduction of a national crypto reserve, intended to create a “digital asset stockpile” consisting of cryptocurrencies seized by federal law enforcement.

While Trump has previously floated the notion of a national Bitcoin reserve, the new policy takes a more inclusive approach, incorporating U.S.-developed altcoins in addition to BTC. This strategy reflects a commitment to broader digital asset acceptance.

The cryptocurrency sector has reacted positively to the executive order, which has been long-awaited by industry advocates seeking clearer governmental support since Trump first took office. As of 6:40 a.m. Nigerian time, Bitcoin was priced at $104,971—a 2.8% increase from the previous day—after hitting an intraday peak of $106,820. Ethereum also experienced a boost, climbing 5% to reach $3,376. The global cryptocurrency market capitalization rose by 2.65%, totaling $3.61 trillion.

Several major altcoins mirrored this upward trend, with Solana gaining 4%, XRP increasing by 1%, Dogecoin up by 1.3%, Cardano growing by 3.5%, and Chainlink surging by 5.2%. Other altcoins like Tron and Avalanche also saw gains. Data from CoinMarketCap indicated that stablecoins currently represent a volume of $189.11 billion, accounting for 91.79% of the total 24-hour trading volume in the crypto market.

In the last 24 hours, Bitcoin’s market capitalization jumped to $2.079 trillion, solidifying its dominance with a market share of 57.49%. The trading volume for Bitcoin surged by 73.5%, hitting $100.98 billion.

Additionally, on Thursday, President Trump addressed the World Economic Forum in Davos, expressing his ambition to position the United States as the “world capital of AI and crypto.” These remarks marked his first explicit reference to cryptocurrency since taking office. He highlighted that increased domestic oil and gas production would not only advance U.S. manufacturing but also bolster the country’s standing as a leader in AI and cryptocurrency.

The absence of direct remarks about crypto had left some industry insiders uneasy, and Bitcoin prices reacted positively to the recent comments. The market was further buoyed by news of Senator Cynthia Lummis being appointed as chair of the Senate Banking Subcommittee on Digital Assets.

Join our Channel...