Bitcoin and Other Cryptocurrencies Decline Ahead of Trump Inauguration

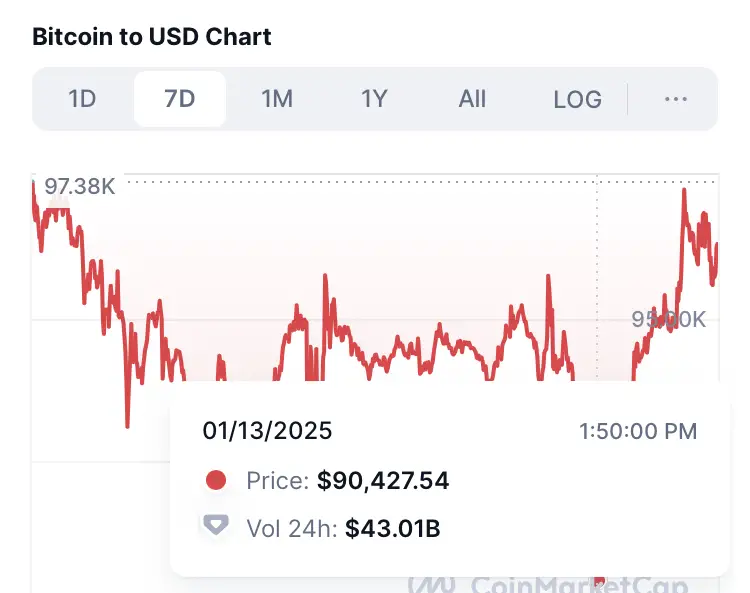

The value of Bitcoin has taken a hit, plummeting below $95,000 just a week before the inauguration of President-elect Donald Trump. The cryptocurrency’s price dipped below $91,000 on Monday morning before recovering some lost ground. This decline is being attributed to speculation that the US Federal Reserve’s window for further interest rate cuts is closing, which has had a ripple effect on the broader cryptocurrency market.

As of Monday afternoon, Bitcoin had dropped around 3% to $91,400.96. Despite reaching a record high of $108,316 last month, the token’s advance since the US Election Day has slowed to around 40%. Other cryptocurrencies have also taken a hit, with Ethereum’s native token, Ether, falling more than 5% to $3,083.01 apiece, Solana dropping nearly 6%, and Dogecoin decreasing almost 5%. Cardano’s price has plummeted nearly 8%.

Investors are growing increasingly concerned about the potential impact of President-elect Trump’s policies on the economy, including his stance on inflation and tariffs. This has led to a decline in investor confidence in the cryptocurrency market. According to Charlie Morris, Chief Investment Officer at ByteTree Asset Management, “It makes little sense to try to call a turn until markets get a sense of what the new administration will really mean.”

While President-elect Trump has appointed a cryptocurrency advocate to chair the Securities and Exchange Commission, investors are still uncertain about the future of the industry. However, many in the crypto community believe that this is a temporary correction and are optimistic about an enduring boom under Trump’s administration.

Some notable developments that could impact the cryptocurrency market include:

- The appointment of Paul Atkins, a cryptocurrency advocate, to chair the Securities and Exchange Commission

- President-elect Trump’s calls for a strategic national Bitcoin reserve and his support for mining Bitcoin in the US

- The potential for increased adoption and legitimization of digital assets under Trump’s administration

Trump’s Effect on Bitcoin

Following Donald Trump’s election as U.S. President, Bitcoin surpassed the $100,000 mark for the first time, prompting Trump to celebrate on Truth Social, saying, “CONGRATULATIONS BITCOINERS!!! $100,000!!! YOU’RE WELCOME!!!” This milestone, marking a more than 50% increase since his victory, was influenced by Trump’s appointment of Paul Atkins—a known cryptocurrency advocate—as head of the U.S. Securities and Exchange Commission (SEC), suggesting a potential shift towards a more deregulated cryptocurrency environment.

Bitcoin hit a peak of $103,800.45 before settling around $101,000, reflecting a 140% surge since the start of 2023. The change in leadership at the SEC, moving away from the strict regulations imposed by Gary Gensler, has raised hopes for a friendlier regulatory landscape for digital assets. Trump has notably shifted his stance from previously calling cryptocurrencies a “scam” to actively promoting them as vital for the U.S. economy during his campaign.

As anticipation builds for Trump’s policies, discussions about forming a strategic Bitcoin reserve and enhancing Bitcoin’s legitimacy globally are underway. Despite Bitcoin’s progress, it continues to face challenges, including associations with criminal activities and its environmental impact. As Trump prepared to assume office in January, the cryptocurrency industry was keenly awaiting how his regulatory and policy shifts would shape the future of digital assets in America.

As the United States prepares for Trump’s inauguration on January 20th, all eyes are on the cryptocurrency markets to see how they will react to the new administration’s policies.

Join our Channel...