In recent years, blockchain technology has emerged as a transformative force across various industries. The article covers the basic of blockchain integration to business.

Introduction

Initially recognized for its role in powering cryptocurrencies like Bitcoin, blockchain’s potential extends far beyond digital currencies. Its unique characteristics—decentralization, transparency, security, and immutability—make it an attractive solution for numerous business challenges. This article explores the fundamentals of blockchain technology, its applications in different sectors, the benefits and challenges of integration, and future trends that may shape its evolution in the business landscape.

OUTLINE

Chapter 1: Understanding Blockchain Technology

Blockchain technology is revolutionizing the way we think about data, transactions, and trust in the digital age. Picture a world where you can securely transfer ownership of assets without the need for intermediaries like banks or government authorities. That is the promise of blockchain: decentralized, transparent, and secure method of recording transactions.

1.1 What is Blockchain?

At its core, blockchain is simply a type of digital ledger that records transactions in a way that makes them nearly impossible to alter or delete. In other word, it is a distributed ledger technology (DLT) that allows multiple parties to maintain a shared database without the need for a central authority.

Each transaction is bundled and recorded into a “block,” which is then linked to the another or previous block, forming a “chain” (hence the name “blockchain”). This chain structure of blocks(blockchain) provides a chronological order of transactions that is visible to all participants in the network. All participant of that network have access to the same information, fostering transparency and trust.

1.2 Key Components of Blockchain

Blockchain technology is built on several key components that work together to create a secure, transparent, and efficient system for recording transactions. Understanding these components is crucial for grasping how blockchain operates and why it is considered revolutionary. This section will delve into two fundamental elements which are: Distributed Ledger and Consensus Mechanisms.

1.2.1 Distributed Ledger

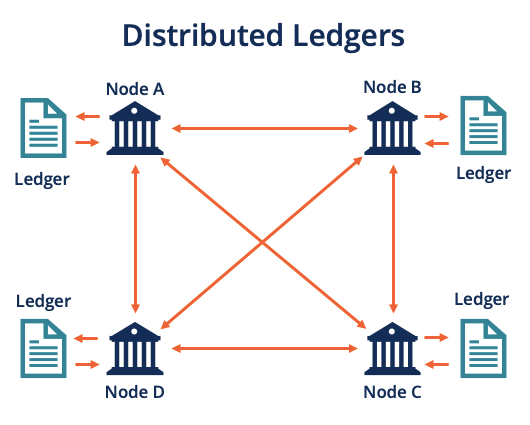

The distributed ledger is the backbone of blockchain technology. It serves as a database that is not stored in one central location but is instead shared across a network of computers, known as nodes. Each node maintains its own copy of the entire ledger, ensuring that all participants have access to the same information.

Key Features of Distributed Ledgers

- Decentralization: Unlike traditional databases managed by a single entity (like a bank or government), a distributed ledger operates on a peer-to-peer network. This means that no single participant has control over the entire database, reducing the risk of fraud or data manipulation.

- Immutability: Once data is recorded in a distributed ledger, it cannot be altered or deleted. This is achieved through cryptographic techniques that secure each entry. If someone attempts to change an entry, it would require altering every subsequent entry across all copies of the ledger, which is practically impossible.

- Transparency: All transactions recorded in the distributed ledger are visible to all participants in the network. This transparency builds trust among users, as everyone can verify the legitimacy of transactions.

- Efficiency: Transactions can be processed quickly because they do not require intermediaries to validate them. Updates are made in real-time across all nodes, ensuring that everyone has access to the latest information almost instantaneously.

- Fault Tolerance: The decentralized nature of distributed ledgers makes them resilient to failures. If one node goes offline or experiences issues, other nodes continue to operate normally, preserving the integrity and availability of the data.

Key Features of Distributed Ledgers

Acronym: DEFICT

- Decentralization: Unlike traditional databases managed by a single entity (like a bank or government), a distributed ledger operates on a peer-to-peer network. This means that no single participant has control over the entire database, reducing the risk of fraud or data manipulation.

- Efficiency: Transactions can be processed quickly because they do not require intermediaries to validate them. Updates are made in real-time across all nodes, ensuring that everyone has access to the latest information almost instantaneously.

- Fault Tolerance: The decentralized nature of distributed ledgers makes them resilient to failures. If one node goes offline or experiences issues, other nodes continue to operate normally, preserving the integrity and availability of the data.

- Immutability: Once data is recorded in a distributed ledger, it cannot be altered or deleted. This is achieved through cryptographic techniques that secure each entry. If someone attempts to change an entry, it would require altering every subsequent entry across all copies of the ledger, which is practically impossible.

- Transparency: All transactions recorded in the distributed ledger are visible to all participants in the network. This transparency builds trust among users, as everyone can verify the legitimacy of transactions.

How Distributed Ledgers Work

- Consensus: Before any transaction is finalized and added to the ledger, all nodes must reach an agreement on its validity through consensus mechanisms (discussed in the next section).

- Data Replication: When a transaction occurs, it is replicated across all nodes in the network. Each node processes and verifies this transaction independently.

- Synchronization: After processing, nodes synchronize their ledgers to ensure they all reflect the same data. This synchronization happens almost instantaneously due to modern communication technologies.

- Data Replication: When a transaction occurs, it is replicated across all nodes in the network. Each node processes and verifies this transaction independently.

- Synchronization: After processing, nodes synchronize their ledgers to ensure they all reflect the same data. This synchronization happens almost instantaneously due to modern communication technologies.

1.2.2 Consensus Mechanisms

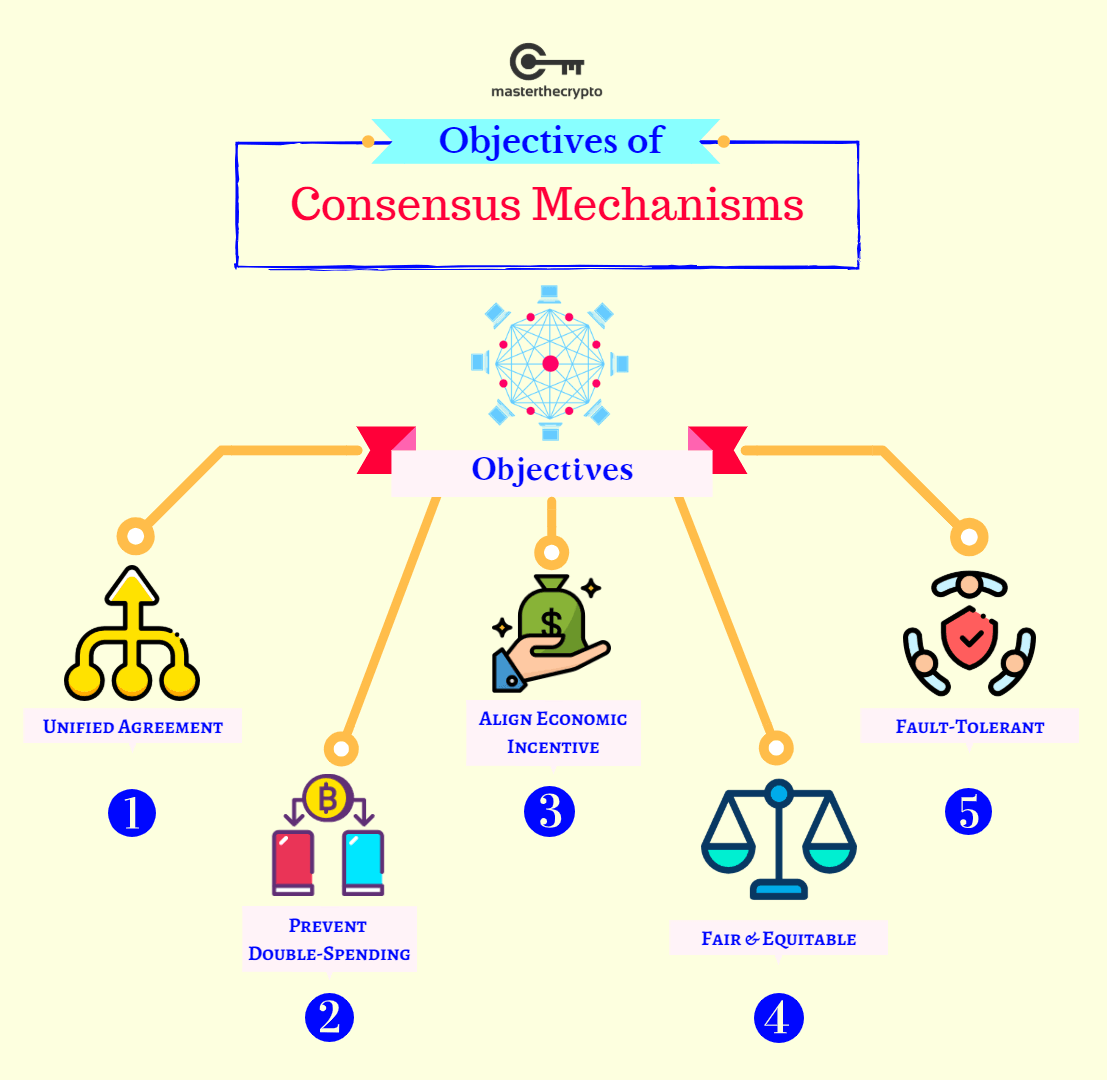

Consensus mechanisms are protocols that ensure all nodes in a blockchain network agree on the validity of transactions before they are added to the distributed ledger. They play a critical role in maintaining the integrity and security of the blockchain by preventing fraudulent activities and ensuring that every participant has a consistent view of the data.

Importance of Consensus Mechanisms

- Validation: Consensus mechanisms validate transactions by requiring multiple nodes to agree on their legitimacy before they are recorded on the blockchain.

- Security: They protect against malicious actors attempting to manipulate or falsify transactions by making it difficult for any single entity to control the network.

- Trust: By ensuring that all participants have a unified view of the data, consensus mechanisms foster trust among users who may not know each other personally.

Common Types of Consensus Mechanisms

Faster transaction processing times due to fewer computational requirements.

- Proof of Work (PoW): It is used by Bitcoin and several other cryptocurrencies. In PoW systems, participants known as miners compete to solve complex mathematical problems. The first miner to solve the problem gets to add a new block of transactions to the blockchain and is rewarded with cryptocurrency. PoW requires significant computational power and energy consumption but enhances security by making it costly for malicious actors to attack the network. The process involves:

a. Miners collecting pending transactions from users.

b. Competing to solve a cryptographic puzzle.

c. Validating and adding blocks once solved.

2. Proof of Stake (PoS): An alternative to PoW that aims to reduce energy consumption. In PoS systems, validators are chosen based on how many coins they hold and are willing to “stake” as collateral. Instead of competing against each other, validators are selected randomly or based on their stake size to create new blocks. This method encourages long-term investment in the network since validators have something at stake (their coins). Benefits include: Lower energy consumption compared to PoW.

1.2.3 Smart Contracts

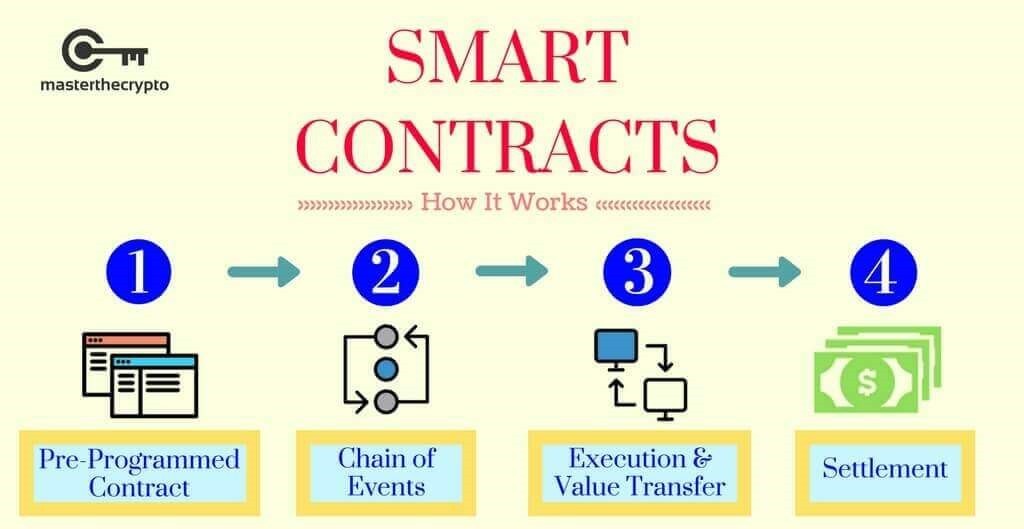

Smart contracts are a groundbreaking innovation in the realm of blockchain technology. They are essentially self-executing contracts with the terms of the agreement directly written into code. This means that once certain predetermined conditions are met, the contract automatically enforces itself without the need for intermediaries, such as lawyers or banks. This automation significantly reduces transaction times and enhances efficiency.

What Are Smart Contracts?

A smart contract is a computer program that runs on a blockchain and automatically executes actions when specified conditions are met. Simply, think of smart contracts as digital agreements that operate like vending machines: you insert your money (condition), and if you select an item (trigger), the machine dispenses your product (execution).

Key Features of Smart Contracts

- Automation: Smart contracts eliminate the need for manual intervention by automatically executing actions when conditions are satisfied. For example, in a real estate transaction, once payment is confirmed, ownership of the property can automatically transfer to the buyer.

- Transparency: All parties involved can view the terms and execution of a smart contract on the blockchain. This transparency helps build trust among participants, as everyone can verify that the contract is executed as agreed.

- Security: Smart contracts leverage blockchain’s cryptographic security features, making them tamper-proof and resistant to fraud. Once deployed, they cannot be altered, ensuring that the agreed-upon terms remain intact.

- Cost Efficiency: By removing intermediaries, smart contracts reduce transaction costs associated with traditional agreements. This efficiency can lead to significant savings, particularly in industries like finance and real estate.

How Do Smart Contracts Work?

The operation of smart contracts involves several key steps:

- Agreement on Terms: The parties involved must first agree on the terms and conditions of the contract. This includes defining what actions will trigger execution and what outcomes will result from those actions.

- Coding the Contract: Once the terms are established, a developer writes them into code using programming languages designed for blockchain platforms (e.g., Solidity for Ethereum). This code encodes the logic of the agreement.

- Deployment on Blockchain: After coding, the smart contract is deployed on a blockchain network by sending a transaction that includes the compiled code to be added to a block in the chain.

- Monitoring Conditions: The smart contract continuously monitors for specific conditions or events that have been predefined in its code. These conditions could include anything from payment confirmations to data inputs from external sources.

- Execution: When the specified conditions are met, the smart contract automatically executes the agreed-upon actions without any need for human intervention. For instance, if a payment is made for a service, the smart contract might automatically release access to that service.

- Recording Outcomes: Finally, once executed, the results of the smart contract are recorded on the blockchain, creating an immutable record of what occurred during the transaction.

Real-World Applications of Smart Contracts

Smart contracts have numerous applications across various industries:

- Finance: In decentralized finance (DeFi), smart contracts facilitate lending, borrowing, and trading without traditional financial institutions.

- Supply Chain Management: Smart contracts can automate processes such as order fulfillment and payment releases when goods are delivered.

- Insurance: They can streamline claims processing by automatically releasing payments when certain conditions (like an accident report) are verified.

- Real Estate: Smart contracts simplify property transactions by automating title transfers and payments upon meeting contractual obligations.

1.2.4 Cryptographic Hashing

Cryptographic hashing is another essential component of blockchain technology that ensures data integrity and security. It involves converting input data into a fixed-size string of characters (known as a hash) using mathematical algorithms.

![Blockchain Basics: How to Integrate This Technology into Your Business What Is Cryptographic Hash? [A Beginner's Guide]](https://trinity-core.s3.us-west-1.amazonaws.com/techjury/assets/64e76142025cc.png)

What is Cryptographic Hashing?

At its core, cryptographic hashing transforms any input data, whether it’s a transaction record or a file—into a unique string of characters that represents that data securely. This process serves several critical functions in blockchain:

- Data Integrity: Hashing ensures that any change made to input data will result in a completely different hash output. This means that if even one character is altered in a transaction record, its corresponding hash will change dramatically, alerting users to potential tampering.

- Linking Blocks: Each block in a blockchain contains not only its own hash but also the hash of the previous block. This creates a secure chain where each block is linked to its predecessor. If someone attempts to alter any block’s data, it would change its hash and break this link, making it immediately apparent that tampering has occurred.

- Efficient Data Verification: Hashes allow for quick verification of data integrity without needing to compare entire datasets. Users can simply check hashes to confirm whether data has been altered.

How Cryptographic Hashing Works

- Input Data: A user inputs data into a hashing algorithm (e.g., SHA-256).

- Hash Generation: The algorithm processes this data and generates a fixed-size hash value (e.g., 256 bits).

- Output Hash: The resulting hash is unique to that specific input; even small changes in input will produce vastly different hashes.

Real-World Applications of Cryptographic Hashing

- Blockchain Security: Every transaction recorded on a blockchain is hashed to ensure its integrity and security against unauthorized changes.

- Password Storage: Instead of storing passwords directly, systems store hashes of passwords so that even if data is compromised, actual passwords remain secure.

- Digital Signatures: Hashes play a crucial role in digital signatures by ensuring that signed documents have not been altered after signing.

1.3 How Blockchain Works

When a transaction occurs:

- It is grouped with others into a block.

- The block is transmitted across the network for validation.

- Nodes use consensus mechanisms to verify transactions.

- Once validated, the block is added to the existing chain.

- The updated ledger is distributed across all nodes.

Chapter 2: Benefits of Blockchain for Businesses

Blockchain technology offers a multitude of benefits that can significantly enhance business operations across various industries. By leveraging its unique features, organizations can improve transparency, security, cost efficiency, speed, and traceability.

2.1 Transparency

One of the most significant advantages of blockchain is its inherent transparency. Every transaction recorded on a blockchain is visible to all participants in the network, creating an open and verifiable system. This transparency fosters trust among stakeholders, as everyone can independently verify transaction histories and ensure compliance with agreed-upon terms.

Key Aspects of Transparency

- Shared Ledger: All participants have access to the same version of the ledger, which reduces discrepancies and disputes over transaction records.

- Auditability: The transparent nature of blockchain allows for easy auditing of transactions, making it simpler for organizations to comply with regulatory requirements.

- Accountability: With a clear record of all transactions, businesses can hold parties accountable for their actions. This is particularly beneficial in industries like finance, supply chain management, and healthcare, where accountability is crucial.

Real-World Applications

- Supply Chain Management: Companies like IBM and Walmart use blockchain to track products from origin to consumer. This transparency helps consumers verify the authenticity of products and ensures compliance with safety standards.

- Financial Services: In banking and finance, transparency reduces the risk of fraud and enhances trust between institutions and their customers.

2.2 Security

The security provided by blockchain technology is another compelling benefit. Its decentralized nature makes it highly resistant to fraud and cyberattacks. Data stored on a blockchain cannot be easily altered or deleted without consensus from the network participants.

Key Aspects of Security

- Decentralization: Unlike traditional databases that rely on a central authority, blockchain distributes data across multiple nodes. This decentralization means that there is no single point of failure that can be exploited by attackers.

- Cryptographic Protection: Blockchain employs advanced cryptographic techniques to secure data. Each transaction is encrypted and linked to the previous one through hashing, ensuring that any attempt to alter a block will be evident.

- Immutability: Once data is recorded on the blockchain, it becomes nearly impossible to change or delete it. This immutability protects sensitive information from unauthorized access and manipulation.

Real-World Applications

- Healthcare: Blockchain can securely store patient records while allowing authorized healthcare providers access when necessary. The immutability of records ensures that patient data remains accurate and tamper-proof.

- Financial Transactions: Cryptocurrencies like Bitcoin leverage blockchain security features to protect against fraud and unauthorized transactions.

2.3 Cost Efficiency

By eliminating intermediaries and automating processes through smart contracts, businesses can achieve significant cost efficiency with blockchain technology. Traditional transaction methods often involve multiple parties—such as banks or brokers—each taking a cut of the transaction fees.

Key Aspects of Cost Efficiency

- Reduced Intermediaries: Blockchain allows for direct peer-to-peer transactions without the need for intermediaries, reducing costs associated with fees and commissions.

- Automation through Smart Contracts: Smart contracts automate various processes, such as payment releases or contract enforcement, which minimizes the need for manual intervention and reduces administrative costs.

- Lower Operational Costs: By streamlining processes and reducing reliance on third parties, businesses can lower their overall operational costs significantly.

Applications

- Real Estate Transactions: Blockchain can automate property transfers and title management through smart contracts, reducing legal fees and administrative costs associated with traditional real estate transactions.

- Cross-Border Payments: Financial institutions using blockchain for international payments can significantly reduce transaction fees compared to traditional wire transfers.

2.4 Speed

The ability to process transactions in real-time or near real-time is another significant advantage of blockchain technology. In industries where speed is critical—such as finance, logistics, and e-commerce—this capability can lead to improved customer satisfaction and operational efficiency.

Key Aspects of Speed

- Instant Transactions: Blockchain allows for immediate settlement of transactions without the delays associated with traditional banking systems that often take days to process cross-border payments.

- Automated Processes: Smart contracts facilitate automatic execution of agreements when conditions are met, further speeding up transaction times by eliminating manual checks.

Applications

- Financial Services: In trading environments where milliseconds matter, blockchain enables faster execution of trades compared to traditional systems that rely on multiple intermediaries.

- Supply Chain Logistics: Companies using blockchain can track shipments in real-time, allowing for faster response times in inventory management and order fulfillment.

2.5 Improved Traceability

Blockchain enhances traceability, particularly in supply chains where tracking the origin and movement of products is essential. With its immutable record system, businesses can provide detailed histories of products from source to consumer.

Key Aspects of Traceability

- Immutable Records: Every transaction related to a product from production to delivery—is recorded on the blockchain in an unchangeable format. This allows businesses to trace back through every stage of the supply chain easily.

- Verification of Authenticity: Consumers can verify product origins using blockchain data, which helps combat counterfeit goods and ensures compliance with safety regulations.

Real-World Applications

Luxury Goods: Brands such as LVMH are implementing blockchain solutions to verify the authenticity of luxury items, helping protect their brand reputation against counterfeit products.

Food Safety: Companies like Nestlé use blockchain technology to track food products from farms to store shelves. This traceability enables quick responses in case of food safety issues or recalls.

Chapter 3: Applications of Blockchain in Various Industries

Blockchain technology is not limited to cryptocurrencies; its applications span multiple industries, transforming traditional business models and practices.

3.1 Financial Services

The financial services industry has been one of the earliest adopters of blockchain technology, recognizing its potential to streamline operations and reduce costs. Here are some key applications within this sector:

3.1.1 Cross-Border Payments

Traditional international payments often involve multiple intermediaries, leading to delays and high fees. Blockchain technology changes this dynamic by enabling peer-to-peer transactions that can be completed within minutes.

- Speed: Transactions that typically take several days can now be executed almost instantaneously.

- Cost Reduction: By eliminating intermediaries, blockchain significantly lowers transaction fees, making cross-border payments more accessible.

- Transparency: All participants in a transaction can view the transaction history, enhancing trust and accountability.

For example, companies like Ripple are leveraging blockchain to facilitate real-time international payments, allowing banks and financial institutions to send money across borders quickly and efficiently.

3.1.2 Decentralized Finance (DeFi)

Decentralized Finance (DeFi) platforms utilize blockchain technology to provide financial services without traditional banks or financial institutions as intermediaries. This ecosystem allows users to lend, borrow, and trade assets directly.

- Accessibility: DeFi platforms are open to anyone with an internet connection, promoting financial inclusion.

- Smart Contracts: Automated agreements execute transactions without the need for intermediaries, reducing costs and increasing efficiency.

- Innovation: DeFi is driving the creation of new financial products and services that challenge traditional banking models.

Platforms like Aave and Compound enable users to earn interest on their cryptocurrency holdings or borrow against them without relying on traditional banks.

3.1.3 Securities Trading

Blockchain streamlines the securities trading process by providing real-time settlement capabilities, which reduces risks associated with delays and errors while enhancing transparency in trading activities.

- Instant Settlement: Transactions can be settled in real-time rather than the typical T+2 (trade date plus two days) settlement period.

- Reduced Counterparty Risk: The transparency of blockchain reduces the risk of fraud and errors in trading.

- Automated Compliance: Smart contracts can automatically enforce compliance with regulations during trading activities.

Companies like tZERO are pioneering blockchain-based trading platforms that offer faster settlements and improved security for investors.

3.2 Supply Chain Management

Blockchain technology is revolutionizing supply chain management by providing enhanced traceability and transparency throughout the supply chain process.

3.2.1 Tracking Goods

Companies can track products from origin to consumer using blockchain technology, ensuring authenticity and reducing fraud risks associated with counterfeit goods.

- Immutable Records: Each transaction related to a product is recorded on the blockchain, creating a tamper-proof history of its journey.

- Consumer Trust: Customers can verify the authenticity of products, enhancing brand loyalty and trust.

- Regulatory Compliance: Companies can easily demonstrate compliance with safety standards by providing transparent records of product origins.

For instance, Walmart uses blockchain technology to trace food products from farms to store shelves, ensuring food safety and quality control.

3.2.2 Inventory Management

Smart contracts automate inventory tracking and reorder processes based on predefined conditions, improving efficiency and reducing human error.

- Real-Time Data: Businesses can access up-to-date inventory levels across all locations.

- Reduced Human Error: Automation minimizes mistakes associated with manual inventory tracking.

- Cost Savings: Efficient inventory management reduces excess stock and associated holding costs.

Companies like IBM are developing solutions that integrate blockchain with IoT devices for smarter inventory management systems.

3.3 Healthcare

In healthcare, blockchain technology enhances data security, patient privacy, and interoperability among different healthcare systems.

3.3.1 Electronic Health Records (EHR)

Patients can control their health data stored on secure blockchain platforms while allowing healthcare providers access when necessary for treatment purposes.

- Patient Empowerment: Individuals have ownership of their health records and can share them securely with providers as needed.

- Data Integrity: The immutability of blockchain ensures that patient data remains accurate and tamper-proof.

- Interoperability: Different healthcare systems can share data securely without compromising patient privacy.

Organizations like Medicalchain are developing blockchain-based platforms that allow patients to manage their health records securely while facilitating access for healthcare providers.

3.3.2 Clinical Trials

Blockchain ensures data integrity in clinical trials by providing an immutable record of trial results and participant consent, which enhances trust among stakeholders.

- Transparency in Results: Researchers can publish trial results on the blockchain, ensuring accountability in reporting outcomes.

- Participant Consent Management: Smart contracts can automate consent processes for trial participants, ensuring compliance with regulations.

- Data Security: Sensitive trial data is securely stored on the blockchain, protecting it from unauthorized access or tampering.

Companies like Chronicled are using blockchain to streamline clinical trial processes while ensuring data integrity throughout the research lifecycle.

3.4 Real Estate

Blockchain technology simplifies real estate transactions by enhancing transparency and efficiency in property management processes.

3.4.1 Property Title Management

By recording property titles on a blockchain, businesses can ensure accuracy and reduce fraud risks in real estate transactions while simplifying title transfers.

- Immutable Records: Property titles recorded on the blockchain cannot be altered or disputed easily.

- Faster Transactions: Title transfers can be executed quickly without lengthy paperwork or legal processes.

- Reduced Fraud Risks: The transparency of ownership records helps prevent fraudulent claims on properties.

Platforms like Propy are leveraging blockchain technology to facilitate seamless property transactions globally.

3.4.2 Smart Contracts for Lease Agreements

Automating lease agreements through smart contracts reduces paperwork and speeds up processes related to rental agreements and property management.

- Automated Payments: Rent payments can be executed automatically based on predefined conditions outlined in the smart contract.

- Simplified Management: Property managers can easily track lease terms and conditions without manual oversight.

- Enhanced Security: Smart contracts ensure that all parties adhere to the agreed-upon terms without ambiguity.

This innovation is transforming how landlords and tenants interact by making agreements more transparent and efficient.

3.5 Energy Sector

Blockchain is also making waves in the energy sector by enabling decentralized energy trading models that empower consumers.

3.5.1 Peer-to-Peer Energy Trading

Consumers can buy and sell excess energy directly with one another using blockchain platforms, promoting renewable energy use while reducing reliance on centralized energy providers.

- Decentralization: Individuals generate their own energy (e.g., solar power) and trade it directly with neighbors without going through a utility company.

- Increased Efficiency: Blockchain facilitates real-time transactions between buyers and sellers, optimizing energy distribution based on demand.

- Empowerment of Consumers: Consumers gain more control over their energy sources and costs while contributing to sustainability efforts.

Projects like Power Ledger are pioneering peer-to-peer energy trading platforms that leverage blockchain technology for efficient energy distribution among consumers.

Chapter 4: Challenges in Blockchain Integration

While blockchain technology offers numerous benefits, its integration into business operations is not without challenges. Organizations seeking to adopt blockchain must navigate a complex landscape of technical, regulatory, and operational hurdles. Despite its potential benefits, integrating blockchain into business operations comes with several challenges:

4.1 Scalability Issues

Scalability remains one of the most significant challenges facing blockchain technology today. Many current blockchain solutions struggle to process large volumes of transactions quickly enough to meet the demands of modern businesses without sacrificing security or decentralization.

Key Aspects of Scalability Challenges

Resource Intensity: Scaling blockchain solutions often requires significant computational resources, which can be costly and environmentally unsustainable. The energy consumption associated with Proof of Work (PoW) mechanisms is particularly concerning

Transaction Speed: Most traditional blockchains, such as Bitcoin and Ethereum, can handle only a limited number of transactions per second (TPS). For example, Bitcoin processes around 7 TPS, while Ethereum handles approximately 30 TPS. In contrast, traditional payment systems like Visa can process thousands of transactions per second.

Network Congestion: During periods of high demand, blockchains can become congested, leading to slower transaction times and increased fees. This congestion can deter users from adopting blockchain solutions for time-sensitive applications.

4.2 Regulatory Uncertainty

The regulatory landscape surrounding blockchain technology is constantly evolving and poses significant challenges for businesses looking to adopt it. Governments worldwide are grappling with how best to regulate cryptocurrencies and related technologies, leading to uncertainty that can hinder investment and innovation.

Key Aspects of Regulatory Challenges

Cross-Border Compliance: Blockchain’s global nature complicates regulatory compliance, as businesses must navigate varying laws and regulations across different countries.

Lack of Clear Guidelines: Many jurisdictions have not established clear regulations governing blockchain technology, leading to confusion among businesses regarding compliance requirements.

Risk of Overregulation: Stricter regulations could stifle innovation and limit the potential benefits of blockchain technology. Companies may hesitate to invest in blockchain solutions if they fear future regulatory changes could render their investments obsolete.

4.3 Interoperability Challenges

Another critical challenge in integrating blockchain technology is interoperability—the ability of different blockchains to communicate and share data seamlessly. Many blockchains operate in isolation, making it difficult for organizations to integrate them with existing systems or collaborate across platforms.

Key Aspects of Interoperability Challenges

Legacy System Integration: Many organizations still rely on legacy systems that are not designed to interact with blockchain networks. This lack of compatibility creates operational bottlenecks and inefficiencies.

Varying Protocols and Standards: Different blockchains use diverse protocols and standards, which can hinder data exchange between networks. This fragmentation limits the potential for collaboration and data sharing across industries.

4.4 Technical Complexity

The technical complexity associated with implementing blockchain solutions presents another significant barrier to adoption. Integrating blockchain into existing technological infrastructures often requires specialized knowledge that may not be readily available within many organizations.

Key Aspects of Technical Complexity

Integration Challenges: The unique data structure and operational mechanisms of blockchain differ significantly from traditional databases, making integration a daunting task that requires careful planning and execution.

Skill Gaps: There is a shortage of skilled professionals who understand blockchain technology deeply enough to implement it effectively. A survey indicated that only about 10% of companies feel they have sufficient talent to leverage blockchain benefits fully.

Join our Channel...