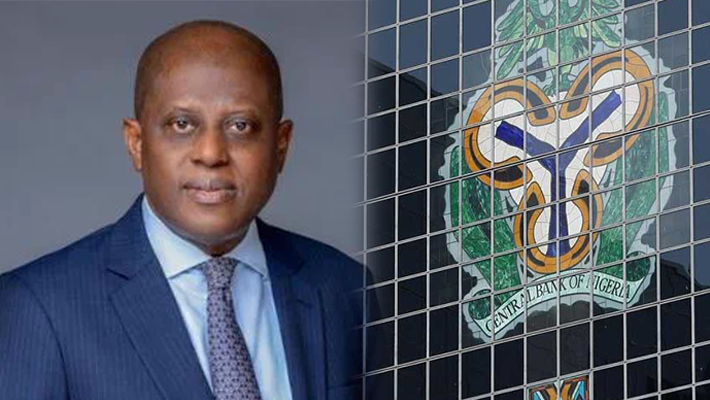

The Central Bank of Nigeria (CBN) has directed banks to provide customers with prior notices of outstanding obligations before commencing debt recovery processes.

The move aims to ensure a transparent, courteous, and fair debt recovery process for consumers.

Released on Thursday via its website, the CBN’s document titled “Revised Consumer Protection Regulations” underscores the importance of adhering to consumer protection principles within financial institutions.

Key highlights from the regulations include guidelines on consumer rights, aiming for improved outcomes and enhanced access to financial services.

According to the document, foreclosure actions should be considered only as a last resort after exhausting all other avenues of debt recovery.

Foreclosure, the legal process wherein ownership transfers to the bank or lender in the event of loan default, should be preceded by offering customers the option of a private sale. Customers must be provided with this option within a 30-day timeframe unless explicitly waived.

Furthermore, financial service providers are mandated to allocate net proceeds from foreclosures to the respective loan accounts and inform customers of any remaining balances.

Banks are also required to furnish customers with detailed reports on collateral sales, including processes, expenses, and net proceeds.

The CBN emphasizes that banks hold accountability for the actions of debt collection agents. Moreover, the document outlines restrictions for loan providers concerning communication with individuals associated with the customer, barring unauthorized disclosures of personal data without express consent.

Additionally, financial service providers are tasked with implementing measures to safeguard customers’ assets, including automated transaction monitoring and fraud detection mechanisms.

Consumers are to be educated on fraud threats, with clear procedures established for reporting suspicious activities or unauthorized transactions.

To enhance digital financial services, banks must offer secure and user-friendly interfaces, while ensuring the privacy and confidentiality of consumer data.

The CBN underscores the importance of obtaining written consent for data collection and processing, with clear opt-in and opt-out mechanisms for data sharing.

The apex bank’s revision of the 2019 Consumer Protection Regulations aims to safeguard consumer interests amidst the evolving financial services landscape.

Join our Channel...