The Nigerian government has imposed a staggering fine of $10 billion on Binance, one of the world’s largest digital asset platforms. The move comes amid growing concerns about the role of cryptocurrency exchanges in facilitating illicit activities and exacerbating currency devaluation in the country.

The announcement of the hefty fine was made by Bayo Onanuga, special adviser on information and strategy to President Bola Tinubu. Onanuga cited Binance’s alleged illegal operations as the primary reason behind the government’s punitive action, pointing to the platform’s purported role in fueling the devaluation of the naira, Nigeria’s national currency.

According to Onanuga, the government’s crackdown on Binance is part of a broader effort to curb the activities of currency speculators and money launderers who exploit cryptocurrency platforms for illicit purposes. Last week, Nigerian authorities initiated coordinated actions against several cryptocurrency exchanges, including OctaFX and Coinbase, in response to reports of their involvement in criminal activities.

The severity of the government’s response to Binance is underscored by remarks made by Yemi Cardoso, Nigeria’s central bank governor, during a recent monetary policy meeting. Cardoso revealed that Binance Nigeria had facilitated transactions totaling over $26 billion from unidentified sources within a single year, raising serious concerns about the platform’s compliance with anti-money laundering regulations.

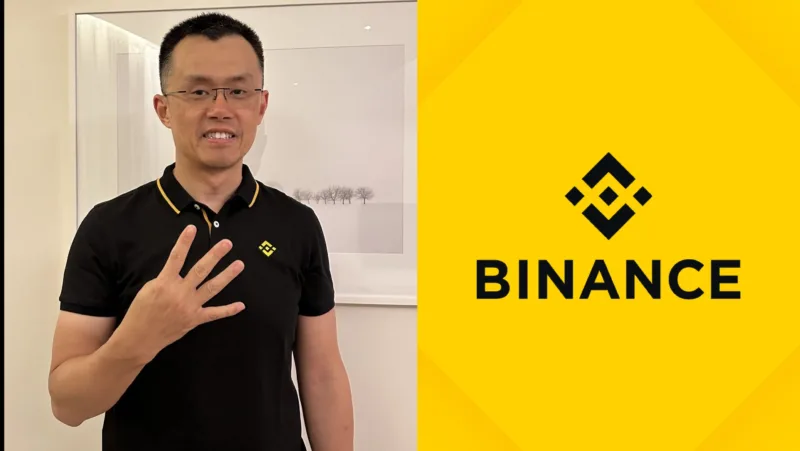

The crackdown on Binance intensified following the detention of two high-profile executives associated with the platform. The executives, who had flown into Nigeria after Binance’s website was banned, were apprehended by the office of the National Security Adviser (NSA) on suspicion of facilitating illegal transactions and money laundering activities.

Reports indicate that Nigerian authorities have demanded extensive data from Binance executives regarding transactions involving the Nigerian Naira on the platform over the past seven years. Additionally, the government has insisted on the deletion of certain data related to Nigeria from the Binance platform, heightening tensions between the authorities and the cryptocurrency exchange.

The standoff between Nigerian authorities and Binance executives escalated further when the latter insisted on being taken to their respective countries’ embassies before complying with the government’s demands. The impasse reflects the challenges inherent in regulating and overseeing cryptocurrency exchanges, particularly when they operate across international borders and navigate complex legal jurisdictions.

The Nigerian government’s crackdown on Binance reflects broader concerns about the proliferation of cryptocurrency-related risks, including financial fraud, money laundering, and market manipulation. While cryptocurrencies offer potential benefits such as financial inclusion and innovation, regulators worldwide are grappling with the need to strike a balance between fostering innovation and mitigating systemic risks.

As the legal and regulatory landscape surrounding cryptocurrencies continues to evolve, stakeholders in Nigeria and beyond will closely monitor the developments surrounding the government’s actions against Binance. The outcome of this high-stakes confrontation is likely to have far-reaching implications for the future of cryptocurrency regulation and the broader financial ecosystem in Nigeria.

Join our Channel...