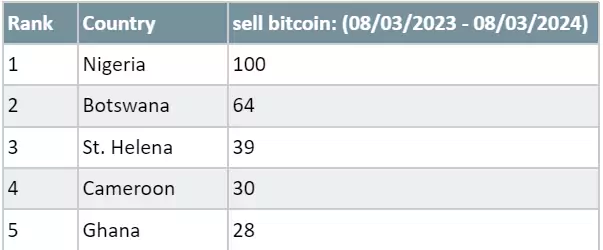

As Bitcoin’s value surges to an unprecedented $69,000, Nigerians have demonstrated a notable trend in their Google searches, with “sell bitcoin” queries skyrocketing by a remarkable 376% globally. The surge in searches has positioned Nigeria at the forefront of this trend, raising questions about the underlying factors driving this phenomenon.

According to a comprehensive analysis of Google Search Trends, the surge in “sell bitcoin” queries coincides with Bitcoin’s meteoric rise to new all-time highs. This surge reflects a growing interest among Nigerians in capitalizing on Bitcoin’s unprecedented valuation, despite lingering uncertainties in the cryptocurrency market.

A report by Invezz.com sheds light on the multifaceted factors fueling Bitcoin’s ascent to record highs. Notably, substantial investments from US finance giants and the approval of spot Bitcoin Exchange-Traded Funds (ETFs) by US regulators have bolstered investor confidence in the cryptocurrency. The influx of institutional investors and the availability of investment products linked to Bitcoin’s price have played pivotal roles in driving its recent price surge.

Despite the optimism surrounding Bitcoin’s latest milestone, experts caution against the cryptocurrency’s inherent volatility. The looming “halving” event, anticipated in April, introduces an additional layer of uncertainty to Bitcoin’s future price trajectory. Historically, halving events, which reduce the rate of new Bitcoin creation, have coincided with price surges. However, the precise impact of this event on Bitcoin’s price remains subject to speculation, amplifying investor apprehension and market volatility.

The cryptocurrency landscape in Nigeria faces additional challenges following Binance’s recent announcement regarding the discontinuation of all services involving the Nigerian naira (NGN). Binance, a leading global cryptocurrency exchange, cited regulatory disputes with the Nigerian government as the primary catalyst for this decision. The Nigerian government accused the platform of manipulating the forex market and engaging in illicit fund movements, prompting Binance to cease its operations involving the NGN.

In an official statement issued to its users, Binance urged Nigerians to proactively withdraw their NGN holdings, engage in NGN asset trading, or convert their NGN balances into cryptocurrencies before March 8. Any remaining NGN balances in users’ Binance accounts would be automatically converted into the Tether (USDT) stablecoin. Despite the government’s imposition of a $10 billion fine on the company, Binance has vehemently denied any knowledge of such penalties.

The regulatory challenges confronting cryptocurrency exchanges in Nigeria underscore the broader complexities surrounding the integration of cryptocurrencies into mainstream financial systems. While Bitcoin’s soaring valuation continues to captivate investors worldwide, regulatory scrutiny and geopolitical tensions pose significant hurdles to the sustained growth and adoption of cryptocurrencies.

In light of these developments, Nigerian authorities face the formidable task of striking a delicate balance between fostering innovation and safeguarding financial stability. The outcome of ongoing regulatory debates and enforcement actions will undoubtedly shape the future trajectory of the cryptocurrency landscape in Nigeria and beyond.

As Nigerians navigate the evolving dynamics of the cryptocurrency market, heightened awareness of regulatory risks and prudent investment strategies are imperative to mitigate potential pitfalls and capitalize on emerging opportunities in this rapidly evolving space.

Join our Channel...