LAGOS, NIGERIA – Oando shares has experienced a significant boost in the third week of January 2025, rising over 14% from an opening price of N62.50 to close at N71.80. This comes after the company reported impressive earnings for the third quarter of 2024, showing a remarkable recovery and robust growth.

Strong Earnings Performance

Oando reported a post-tax profit of N13.6 billion for Q3 2024, marking a 510.48% year-on-year increase compared to a loss of N2.2 billion during the same period in 2023. This brings the company’s total profit for the nine months ending September 30, 2024, to N76.2 billion.

Revenue for Q3 2024 reached N1.1 trillion, a 15.7% increase from the previous year. For the nine-month period, total revenue amounted to N3.1 trillion, with N2.9 trillion attributed to the supply and trading of crude oil, refined, and unrefined petroleum products.

The company’s main operating income grew by 13.7% to N39 billion, driven by exploration and production activities on the Nigerian continental shelf, deep offshore fields, and São Tomé and Príncipe. Other operating income surged 42.1% to N28.5 billion, with foreign exchange gains accounting for over 90% of this figure, bringing the nine-month total to N308.7 billion.

Stock Performance

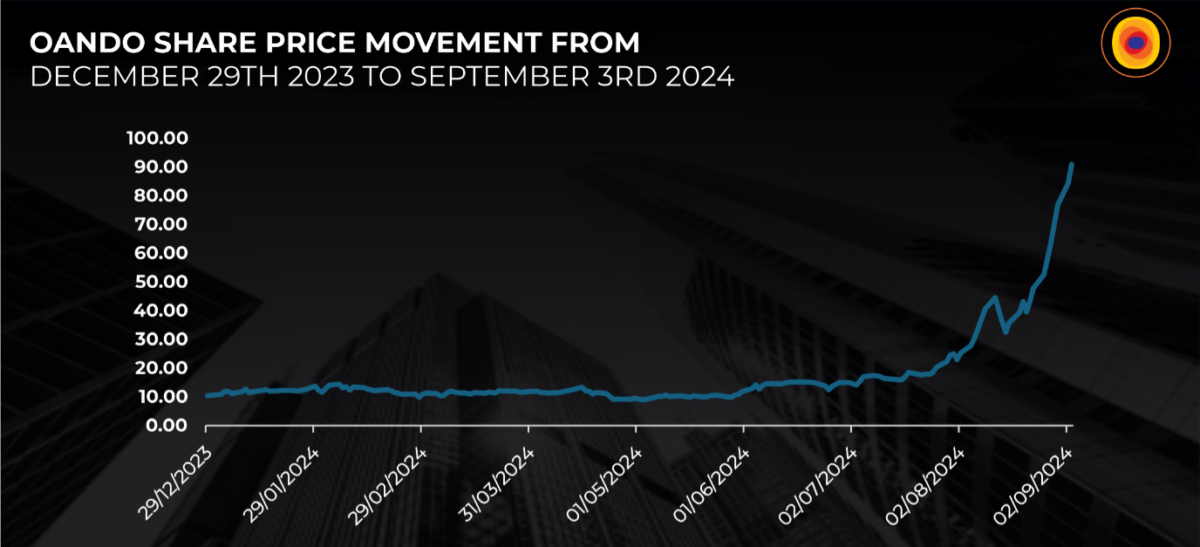

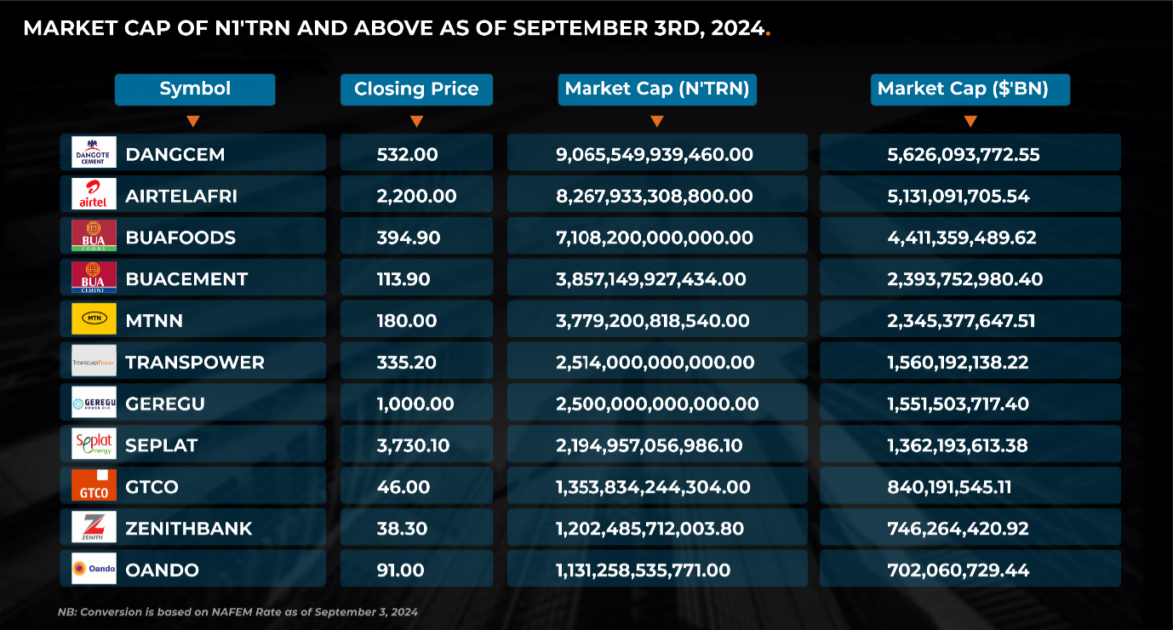

Oando’s stock has shown remarkable performance over the past year, with a year-to-date gain of 528.57% in 2024. The stock started 2024 at N10.50 and experienced a slow first quarter. However, by August, prices surged by over 200%, peaking at over N85 in October before retreating to N64.95 in November.

Following a brief decline to N62.50 in early January 2025, the stock rebounded sharply in the third week of January, gaining over 14%. Analysts suggest the bullish momentum is likely driven by investor confidence in the company’s improved earnings and recovery.

Market Drivers

Oando’s strong Q3 results have been a key driver of the recent stock rally. The 510.48% growth in post-tax profit and the N3.1 trillion total revenue for the nine-month period have bolstered investor confidence. The company also benefited from increased operating income and substantial foreign exchange gains.

Management Remarks

Wale Tinubu, Group Chief Executive of Oando PLC, expressed optimism regarding the company’s performance and growth prospects. He stated,

“Our performance for the nine months ending September 30, 2024, underscores our resilience and steadfast commitment to providing value, even in a challenging operating landscape.”

Tinubu added,

“With this solid foundation and a definitive growth roadmap, we are optimistic about our potential to deliver long-term, sustainable value to all our stakeholders.”

Outlook

As Oando’s stock continues to recover, analysts are watching for further upward corrections in its trajectory, particularly as investor interest grows following the positive earnings report.

Join our Channel...