What Is a Memecoin?

A memecoin is a cryptocurrency usually named after individuals, animals, artwork, cartoons, trends or anything else in an attempt to be funny, light-hearted, and attract a user base by promising a fun community. These cryptocurrencies are usually known for their high volatility giving investors the hope of 1000x on their investment.

The Moon-Rekt Ratio

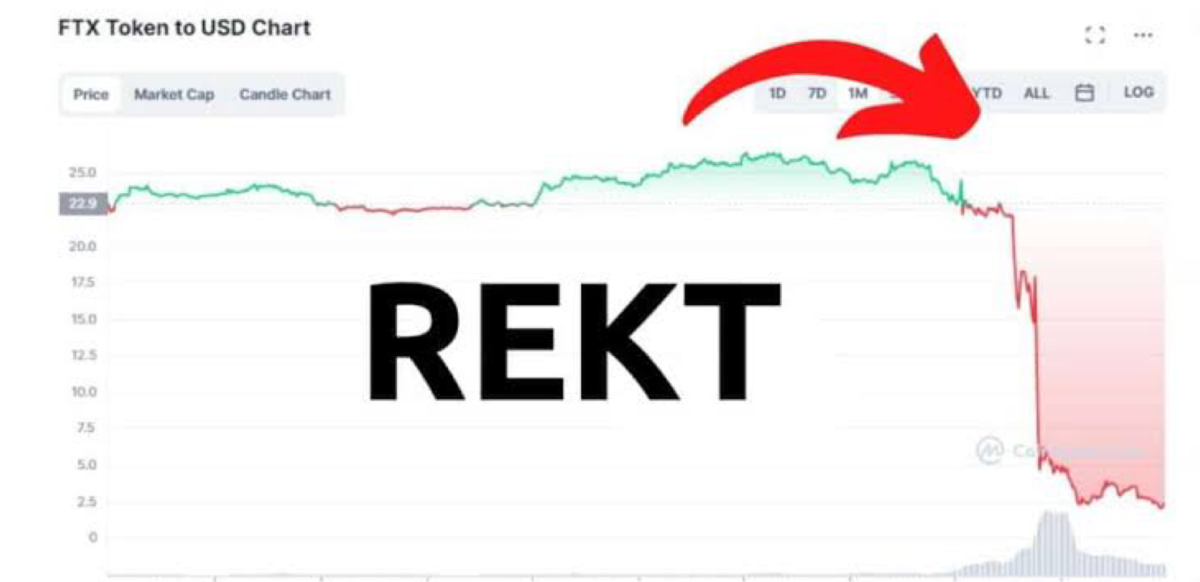

Memecoins have gained notoriety for their association with high-risk investments, primarily due to their foundation in memes and internet humor. Despite the potential for substantial profits, many inexperienced investors often make poor decisions that result in significant losses. Recent on-chain data reveals that among the 1.7 million meme coins, only 15 have demonstrated long-term success, underscoring the trend of most meme coins failing over time.

A staggering 76% of social media influencers promote ‘dead’ meme coins, which are tokens that have plummeted in value by more than 90%. According to a report by CoinWire, around 86% of meme coins endorsed by influencers observed a 10X decline in value within three months. Alarmingly, only 1% of influencers have managed to successfully promote a meme coin that saw a tenfold improvement.

Common Pitfalls of Investing in Memecoins

Pump-and-Dump Schemes:

One considerable risk associated with meme coins is the prevalence of pump-and-dump schemes. In these scenarios, promoters orchestrate mass buying to inflate the coin’s price temporarily and then sell off their holdings for profit, leaving latecomers with worthless tokens. This manipulative tactic often flourishes in markets with minimal regulation and transparency.

Extreme Volatility:

Meme coins are infamous for their severe price fluctuations, often experiencing drastic changes within days. These volatility-driven swings typically arise from hype generated by social media rather than any fundamental value. The speculative nature of meme coins, combined with their drastic price changes, poses considerable risks for investors.

Limited Functionality:

Most meme coins lack functional benefits and are often not interoperable with broader blockchain networks such as DeFi. They usually serve only as tradeable tokens without any significant utility, limiting their applicability and potential for future use.

Regulatory Uncertainty:

The unclear regulatory framework surrounding cryptocurrencies, particularly meme coins, presents a significant risk. New legal standards or enforcement actions could result in sudden value drops or make certain investments illegal almost overnight.

Market Manipulation:

Memes, due to their lower liquidity, are particularly susceptible to market manipulation. Even minor investments can lead to pronounced price changes, creating deceptive patterns that mislead investors.

No Intrinsic Value:

Most meme coins possess no intrinsic value or real-world utility. Their worth is primarily tied to social media trends, community sentiments, and celebrity endorsements, making their valuation purely speculative. Consequently, they are highly vulnerable to rapid devaluation since their prices lack fundamental backing.

High Risk of Scams and Rug Pulls:

Many meme coins are created by anonymous developers who often lack long-term objectives. Instances of “rug pulls,” where creators abandon a project after inflating its price, are unfortunately common. If the developers decide to liquidate their holdings or the project turns out to be fraudulent, investors can lose a significant portion of their investments almost instantly.

Strategies to Mitigate Risks Associated with Memecoins

Knowledge is indeed power, especially when considering investments in meme coins. Prior thorough research on any meme coin is essential for making informed decisions.

Review Official Documentation:

It’s vital to scrutinize the white paper and other official resources to grasp the underlying concepts and goals of the meme coin project.

Practice Risk Management:

A sound investment strategy includes risk management. Diversifying investments across various meme coins can help mitigate losses. Should one or more fail, you’ll still have capital in other ventures, allowing for potential gains across multiple successful projects. Concentrating all your investment in a single token is inherently risky.

Conduct Thorough Research:

Investigate the project’s roadmap, technology, goals, and the team behind it. Ensure alignment of strategic vision and that the project is forward-thinking. It is also important to go through the team’s social media handles to see if there’s an authentic community backing the project and not just bots.

Establish a Profit Strategy:

Creating a plan for profit allocation is crucial when dealing with volatile assets like meme coins. This involves setting criteria for when to sell an asset after its value has increased, allowing for systematic profit-taking.

Conclusion

Memecoins represent one of the most exhilarating asset classes within the blockchain landscape. Although often regarded as whimsical investments, they have proven lucrative for some. However, potential investors must be acutely aware of the associated risks. These assets can be unpredictable, lack transparency, and may suffer from scams and cybersecurity threats.

It is equally important to manage other inherent risks. Controlling emotions in volatile conditions and implementing effective strategies to minimize losses is vital. Ultimately, risk management is crucial in the investment process, emphasizing the need for a clear risk and profit-taking strategy.

![Mexico mayor murdered Few days after Assuming office [Photos] Mexico mayor murdered Few days after Assuming office](https://reportafrique.com/wp-content/uploads/2024/10/D59C6D6E-B13B-4CD7-8AC6-761E5B867E8B-260x195.jpeg)

![Video of Canada-Based Nigerian Calling For Mass Poisoning Of South-Westerners Surfaces [VIDEO] Canada-Based Nigerian Woman Calls For Mass Poisoning Of South-Westerners](https://reportafrique.com/wp-content/uploads/2024/08/689AC4A7-BE12-49D5-AC2E-4324477DB799-260x195.jpeg)

Join our Channel...