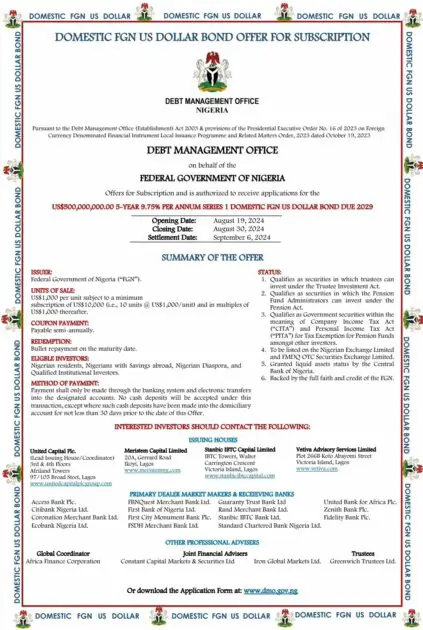

Nigeria’s New $500 Million Bond Offers 9.75% Interest

The Federal Government of Nigeria has issued its inaugural $500 million domestic dollar bond, offering an attractive 9.75% interest rate to investors. This bond, the first of its kind in the Nigerian capital market, is a key part of a $2 billion program aimed at bolstering infrastructure development, enhancing financial inclusion, and strengthening the domestic securities market.

Key Details:

- Minimum Investment: $10,000, with increments of $1,000 thereafter.

- Interest Rate: Investors earn 9.75% interest, paid semi-annually. A $10,000 investment yields $487.5 every six months over five years, with the principal repaid at maturity.

- Issuance Purpose: Funds will support critical sectors of the economy, subject to presidential approval and National Assembly appropriation.

- Eligible Investors: Nigerians, non-Nigerians residing in Nigeria, Nigerians in the diaspora, and Qualified Institutional Investors.

- Issuance Duration: The offer period ran from August 19 to August 30.

- Tenor: Five years.

- Tax Benefits: Interest is exempt from Company Income Tax, Personal Income Tax, and Capital Gains Tax.

- Investment Advantages: Offers higher returns compared to domiciliary accounts and better yields than Eurobonds.

- Risk: Considered low-risk due to government backing.

- Listing: Available on the Nigerian Exchange Limited (NGX) and FMDQ OTC Securities Exchange Limited.

- Financial Advisers and Issuing Houses: Meristem Capital Limited, Stanbic IBTC, Vetiva, and United Capital lead the effort, with the African Finance Corporation as global coordinator.

- Payment Method: Payments, both capital and interest, are made in dollars via Nigerian banks and electronic transfers.

- BVN Requirement: Investors, including those in the diaspora, must provide their Bank Verification Number (BVN).

Differentiating from Eurobonds:

Unlike Eurobonds, which are issued abroad with a $200,000 minimum subscription, this domestic dollar bond is issued locally with a $10,000 minimum, offering greater accessibility and higher returns. With a 9.75% coupon, it surpasses the 9.58% yield on the Federal Government’s $1.25 billion 2029 Eurobond. Additionally, while FGN bonds are denominated in naira, this bond is dollar-based, appealing to investors seeking currency stability.

This new bond initiative is a strategic move to attract local and diaspora investors, providing them with a secure, high-yield investment option while driving economic growth in Nigeria.

Join our Channel...